Planned Giving

For some, you may consider your past and all that you’ve accomplished in life already, while considering the kind of legacy you can provide in the future. For others, like the millions of visitors that visit the parks, marinas, beaches, and golf courses every year, the future is an adventure into the unknown, a future The Parks Foundation is committed to conserving and preserving for future generations.

Make The Parks a Part of Your Legacy

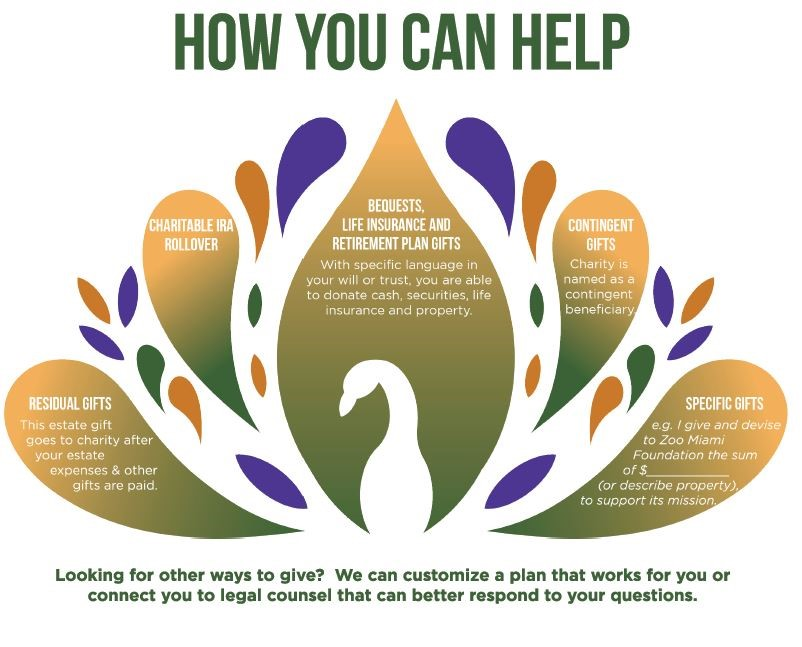

Did you know there are many ways to support The Parks Foundation? Legacy giving techniques are called “planned gifts,” because with thoughtful planning, you create win-win solutions for you and your loved ones, and The Parks Foundation.

A well-planned gift communicates your legacy; it tells a story of what you hold as most important and valuable in your life and community. Leaving a gift to The Parks Foundation through your will or trust is an easy and impactful way to benefit the programs and conservation efforts for years to come. The Parks Foundation is the independent fundraising arm and partner of Miami-Dade County Parks, Recreation and Open Spaces.

Please explore below to learn more about different ways to give and contact us with any questions.

Bequests, Life Insurance and Retirement Gifts

With specific language in your will or trust, you may give cash, securities, life insurance and/or property.

Specific Bequest. A specific bequest involves making a gift of a specific asset such as real estate, a car, other property or a gift for a specific dollar amount. For example, you may wish to leave your home or $10,000 to the Parks Foundation of Miami-Dade.

Percentage Bequest. Another kind of specific bequest involves leaving a specific percentage of your overall estate to charity. For example, you may wish to leave 10% of your estate to the Parks Foundation of Miami-Dade.

Residual Bequest. A residual bequest is made from the balance of an estate after the will or trust has given away each of the specific bequests. A common residual bequest involves leaving a percentage of the residue of the estate to charity. For example, you may wish to leave 30% of the residue of your estate to the Parks Foundation of Miami-Dade.

Contingent Bequest. A contingent bequest is made to charity only if the purpose of the primary bequest cannot be met. For example, you could leave specific property, such as a vacation home, to a relative, but the bequest language could provide that if the relative is not alive at the time of your death, the vacation home will go to the Parks Foundation of Miami-Dade.

How It Works

Include a bequest to the Parks Foundation of Miami-Dade in your will or trust.

Make your bequest unrestricted or direct it to a specific purpose.

Indicate a specific amount or a percentage of the balance remaining in your estate or trust.

Cash, Percentage or Real Estate Bequest Sample Language:

I hereby give, devise and bequeath (dollar amount or % of estate; or describe property) to the Parks Foundation of Miami-Dade, a nonprofit organization supporting Miami-Dade County Parks located at 275 NW 2nd Street, Miami, FL 33128 for its ongoing conservation and education purposes (or for a designated program of your choice). Tax ID Number: 20-0924393

Residual Bequest Sample Language

I hereby give, devise and bequeath to the Parks Foundation of Miami-Dade, a nonprofit organization supporting Miami-Dade County Parks located at 275 NW 2nd Street, Miami, FL 33128, (all or a percentage) of the rest, residue and remainder of my estate for its ongoing conservation and education purposes (or for a designated program of your choice). Tax ID Number: 20-0924393

Contingent Bequest Sample Language

If (primary beneficiary) does not survive me, then I hereby give, devise and bequeath (description of your property/estate) to the Parks Foundation of Miami-Dade, a nonprofit organization supporting Miami-Dade County Parks located at 275 NW 2nd Street, Miami, FL 33128 for its ongoing conservation and education purposes (or for a designated program of your choice). Tax ID Number: 20-0924393

Benefits

Your assets remain in your control during your lifetime.

You can modify your gift to address changing circumstances.

You can direct your gift to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

Please make sure to let us know if we are included in your legacy planning, so we may say “Thank You” by reaching out to Grace Bracamonte, Executive Director at [email protected].

Charitable IRA Rollover

The Charitable IRA Rollover (or sometimes referred to as Qualified Charitable Deductions) provides taxpayers 70 ½ or older with a mechanism for transferring their annual Required Minimum Distributions (RMD’s) directly to charitable organizations.

How it Works

Contact your IRA plan administrator to make a gift from your IRA to the Parks Foundation of Miami-Dade.

Your IRA funds will be directly transferred to our organization to help continue our important work.

Benefits

Avoid taxes on transfers of up to $100,000 from your IRA to our organization.

Make a gift that is not subject to the deduction limits on charitable gifts.

Please make sure to let us know if we are included in your legacy planning, so we may say “Thank You” by reaching out to Grace Bracamonte, Executive Director at [email protected].

Ready To Take The Next Step?

Please contact Grace Bracamonte to learn more at [email protected]